Why do deacons need to know anything at all about economics? Isn’t that beyond the scope of what the diaconate does? Let me give you the answer in two words…

“What happened?”

If a congregation member asked you that question today, will you have an answer?

To understand why deacons need to know at least the basics about economics, you need to look towards the future.

ECONOMIC FRAGILITY

We all know about recessions. Recessions are periods of economic downturns, like what happened in 2008 and again after the coronavirus shock caused by state governors unilaterally, like tyrants, locking down their economies in 2020. The 2008 financial crisis was called the Great Recession because it was so serious. “Great Recession” was meant to remind people of another “great”: the “Great Depression.”

During recessions, people lose their jobs. The people who don’t lose their jobs start getting scared of losing their jobs. In both cases, personal and family budgets are tightened down. Families don’t go out to eat as much. This depresses the restaurant industry, which eventually leads to closures and job losses.

In the next recession, people in your congregation will lose their job. But they’re going to be stuck with their existing expenses. The biggest expense will be their mortgage. Their monthly salary will have stopped coming in, but the bank expects their monthly mortgage payments to keep going out.

Some will be able to find new jobs quickly. Others won’t. Every month that goes by that a mortgage payment comes due without a new salary coming in brings those families one step closer to bankruptcy. People usually don’t panic immediately. They start panicking when their reserves dry up. When they begin approaching the end of their savings, which they used up to pay for all their expenses while they were still looking for a job, that’s when they start to get desperate.

HOW MUCH DO PEOPLE HAVE IN SAVINGS?

How much money does the typical family have saved up for a dry spell?

Articles reporting the results of annual surveys give us a pretty good estimate. You’re not going to like it.

Generally, about 40% of Americans report that they could cover a $1,000 expense with their savings account. They are likely to turn to debt because of their meager savings:

“More than a third would need to borrow the money in some way – either with a credit card, personal loan or from family or friends. Another 14 percent would reduce spending on other things, while 10 percent would either figure out “something else” or don’t know what they would do.”

Anywhere from 60-70% of all people aged 64 and under have less than $1000 in savings.

A small amount of the population has between $1,000 and $5,000 in savings. Few people have more than that, even at age 64 which is close to the normal retirement age.

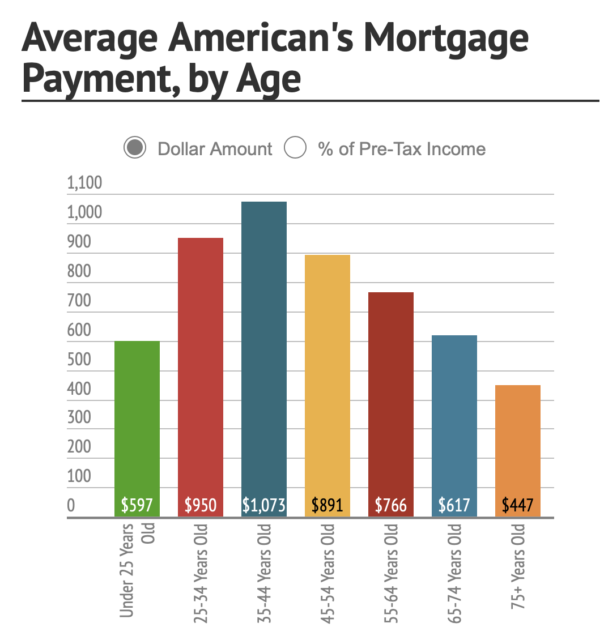

Other studies have broken down what the average American’s mortgage payment is by age, based on the Bureau of Labor and Statistics annual consumer expenditure surveys.

We can combine these two statistics to draw some conclusions.

- Over a third of Americans have nothing in savings. They have absolutely no reserves in case of an emergency of any kind, much less a severe one in which they lose their job. These people are going to become desperate for money quickly. They will turn to credit cards and other forms of debt first.

- About 40% of Americans have, at most, about two months in mortgage payments saved up in cash. They, too, will become desperate quickly if they lose their jobs in a recession and cannot quickly find a new one.

- Maybe 20% of Americans have enough in their savings account to afford between 2 and 9 months’ worth of mortgage payments.

PLANNING FOR THE DOWNTURN

What portion of your congregation do you think has more than $1,000 in savings?

When the next recession hits, and members of your congregation start losing their jobs, they are going to come to the diaconate for help.

Some will need help making their mortgage payments. If they’re fortunate, it’ll only be for a month or two until they get a new job.

But others won’t be as fortunate. They will be faced with losing their houses. If the recession is as bad as the last one, then your church may find dozens of its members asking for financial support from you.

The diaconate’s budgets for emergencies like this are only so big.

You will be forced into a situation in which you won’t be able to help everybody. You will have to develop a system to judge which members receive support, and which won’t. Your criteria had better be Biblical.

As the economic conditions deteriorate and stress mounts, people will get angry. You’re going to have to deal with this.

At some point, the congregation will start asking this question: Why is this happening? They are going to want answers to not only that question, but several others:

Is God punishing them?

Is God punishing the country?

Will this happen again?

Is it possible at all to avoid recessions?

What causes them?

What can we do differently?

Does the Bible tell us why this is happening?

Does the Bible tell us how to avoid this kind of calamity in the future?

What can I do differently to be prepared the next time a recession comes along?

Hopefully, you will be there to give them biblical answers. People will be more willing to trust God, and you, if you can explain why God is not evil for sending recessions. They will feel more secure if you can confidently point out that the Bible offers economic solutions that, if implemented, would prevent the kind of economic destruction that faces the world’s richest economies in a never-ending boom-bust cycle. You will need to foster this trust to enlist cooperation among the church members, especially the ones who are getting hit the hardest.

If you cannot provide Biblical answers to those questions to a member of your congregation right now, then that is why you need to understand economics.

But not just economics.

Christian economics. Not economics the way the world thinks of economics. Not the economics taught in public high schools and universities across the country.

Not the economics that have gotten us into this mess, called “Keynesian economics.”

But the only right form of economics there is: Bible-based Christian economics.

CONCLUSION

Understanding the fundamentals of Bible-based Christian economic theory will provide deacons answers to some of the basic questions their church members might ask about the economy.

Having an understanding of Christian economics can also help prevent future economic catastrophes if enough deacons are able to help educate their church members over time and geography. This can help prevent bad ballot measures from getting passed in the local government. This can help improve the financial condition of a county. It will one day lead to a return to fiscal solvency at the state and Federal level, along with a drastic reduction in taxes.

Most importantly, by understanding Christian economics you can show that free market capitalism is not evil. Its critics believe the free market to be volatile and unstable, and if not “corrected” with government intervention then it will lead to wide-scale unemployment and poverty.

Actually, it is a God-ordained system that protects private property and rewards Biblical work ethic.

It also helps alleviate poverty, as a side-effect.

The government intervention, on the other hand, interferes with the wealth creation, poverty reduction process. It’s the government intervention that must go. But to teach that, you need to believe that. To believe that, you need to understand why.